PayPal and Venmo: Not currently available on invoicing for QuickBooks Online Advanced users. Additional terms and conditions apply.Īpple Pay: Apple Pay is a registered trademark of Apple Inc. Pay-enabled invoices: Requires a separate QuickBooks Payments account which is subject to eligibility criteria, credit and application approval. Assign each invoice you issue with a unique invoice number, and document the invoice number directly on the invoice and in your records. Numbered invoices help ensure that your business income is properly documented when it comes time to pay taxes. Numbering your invoices makes it easy to track payments and keep your accounting records straight. Accurate documentation of the invoices you issue can help you spot outstanding payments as soon as they’re overdue and improve cash flow. Keep track of your invoices using an invoice tracking system, like a spreadsheet or accounting software that automatically records the status of your invoices.

Be sure to track your sent invoices, making note of when the invoice was issued and when payment is due. Then you can either print and mail the invoice to your customer’s billing address, or send the invoice to your customer’s email address. To send an invoice to your customers, first save the completed invoice template.

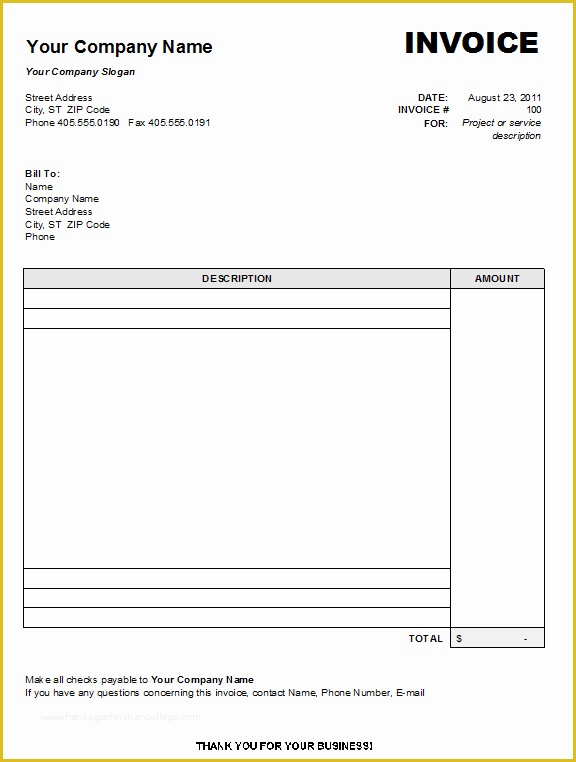

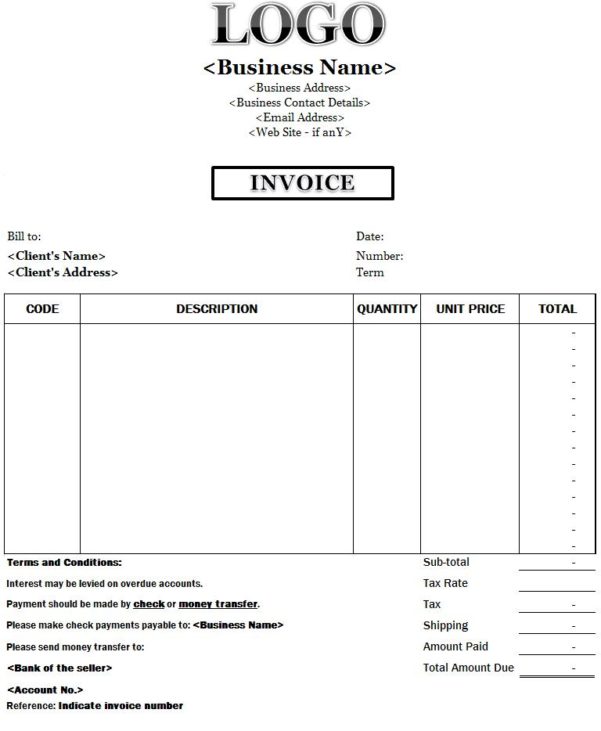

Include the following elements on each invoice you create: Use the fillable invoice template to create an invoice by completing the blank fields in the template with your business, sale, and customer information. An invoice template outlines the necessary fields included on an invoice.

An invoice template is a document that makes it simple to create new invoices.

0 kommentar(er)

0 kommentar(er)